As I sit down on New Year’s Eve day to run through end-of-year personal financials, to make sure Gov has gotten its requisite pounds of flesh, and to see that all the tax-related donations and contributions have been allocated (charities, HSA, 529K, etc), I also run a quick review of where we’ve been financially in 2017 (as an economy) and where we might be headed in 2018. Since the financial crisis of 2008, and its decade-long “recovery,” I’ve long-anticipated the next financial correction. Careful to not become too taken in by the doomsayers, I have to admit an affinity for their significant caution. My personal savings and investment approach has been increasingly cautious and conservative as the un-deserved and unsustainable nose-bleed valuations in financial markets (my personal opinion) continue to march upward.

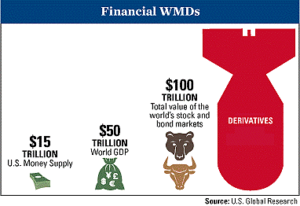

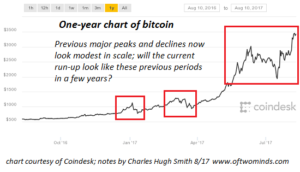

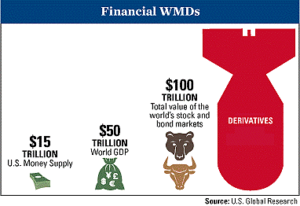

This year has witnessed ever-climbing stock market valuations (with the Dow over 24,000 –  after a low in the 7,000 range in 2009) – without any recognizable rise in productivity or demonstrable wealth that would justify it. We’ve seen blockchain cryptocurrencies take off with Bitcoin rising from the few hundred dollars per BTC, to $18,000 or so, and today back in the $13,000 range. Debt and derivative exposures continue to climb. Some estimates place total global derivative exposure as high as $1.2 Quadrillion USD – about 20 times global GDP. As I wrote about a few months ago on this site, the Too Big To Fail Banks that required bailouts in 2008 are more consolidated and risky than ever.

after a low in the 7,000 range in 2009) – without any recognizable rise in productivity or demonstrable wealth that would justify it. We’ve seen blockchain cryptocurrencies take off with Bitcoin rising from the few hundred dollars per BTC, to $18,000 or so, and today back in the $13,000 range. Debt and derivative exposures continue to climb. Some estimates place total global derivative exposure as high as $1.2 Quadrillion USD – about 20 times global GDP. As I wrote about a few months ago on this site, the Too Big To Fail Banks that required bailouts in 2008 are more consolidated and risky than ever.

Economic cycles are unavoidable (despite extreme and distorting Gov interventionism to the contrary) and historically well-documented. The unknowns are: when and how big the correction. Inescapably (and thankfully so, IMO), change and disruption occur. In our current times and with growing technologies, however, these arrive at a more rapid pace and to potentially greater degrees. How will the current financial system weather the disruptions? After the creation of the US Federal Reserve Bank in 1913, and the dominance of the US dollar as the world’s reserve currency after WWII via the Bretton-Woods agreement, one might wonder if these monetary systems will be sustainable for another century, and just when they will go the way of previous global currency systems. With major systemic monetary challenges, like the rise of government decentralized cyryptocurrenices, and non-US currency/non-petro-dollar currencies (e.g. Sino-Russian currency alliance), it is unlikely that the US dollar will maintain its 20th century global dominance going forward. (How this will all play into US global military hegemony and funding is the topic for another article,… as is the mass of future debt-dependent, unfunded liabilities to the American public, e.g. Medicare, Social Security, government pensions – which stretch into the $200 Trillion range, in the setting of a current national debt of $20 Trillion.)

After clicking around on some articles today, I’ll share some that expand on related topics. Doug Casey shared some thoughts in an interview this week discussing central banking, the historic errors of economic “experts,” the economic interventions that make the market distortions (and eventual correction) much worse than they could have become without central bank and government interference. One excerpt:

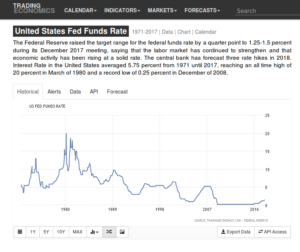

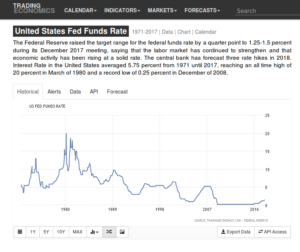

“… the Fed has dropped interest rates to near zero. I used to think it was metaphysically impossible for rates to drop below zero. But the European and Japanese central banks have done it.

“The other thing they did was create megatons of money out of thin air. This hasn’t just happened in the U.S., either. Central banks around the world have printed up trillions of currency units.

“How many more can they print at this point? I guess we’ll find out. Plus, it’s not like these dollars have gone to the retail economy the way they did during the “great inflation” of the ’70s. This time they went straight into the financial system. They’ve created bubbles everywhere.

“That’s why the next crisis is going to be far more serious than what we saw a decade ago.”

Charles Hugh Smith wrote an article at Peak Prosperity entitled “The Inescapable Reason Why the Financial System Will Fail: Credit cannot expand faster than fundamentals forever.” He describes the fundamentals of debt creation via credit, and the global central banks’ efforts to goose the economy by making credit almost free with near-zero interest rates. However, this has had extreme consequences, which few are willing to recognize.

“By lowering interest rates and bond yields to near-zero, central banks deprived institutional owners who rely on stable, high-yielding safe investment income—insurers, pension funds, individual retirement accounts, and so on—of exactly what they need: safe, stable, high-yield returns.

“In this ‘do whatever it takes’ environment, the only way to earn a high return is to buy risk assets—assets such as stocks and junk bonds that are intrinsically riskier than Treasury bonds and other low-risk investments.”

If you wonder why the stock market looks like it’s doing so great, and the economy seems to be humming along by some measures, Mr. Smith just described to you the rot upon which those numbers are predicated. Once interest rates were artificially driven into the floor by central banks in order to juice the economy, there was no longer any return on “safe” investments. In order to seek out a return, the majority of the trillions of dollars that have been created by the central banks has been ploughed into the stock market in order to chase returns. That is just another form of “inflation,” currency devaluation, monetary expansion. The Dow doesn’t sit at 25,000 because it’s worth it. It’s “valued” at ridiculous levels because it’s been the last refuge for those who need to make a return on their investments,… and for those who fear LOSING money on their deposits because of zero and even negative interest rates on deposits. This is not a normal, market environment. This is the consequence of distorting interventionism. The misallocation of those savings and investments, which would not be there otherwise, will become obvious once assessments correct down to accurate values. When that happens, those that sought return at the expense of safety, will experience significant losses.

If you wonder why the stock market looks like it’s doing so great, and the economy seems to be humming along by some measures, Mr. Smith just described to you the rot upon which those numbers are predicated. Once interest rates were artificially driven into the floor by central banks in order to juice the economy, there was no longer any return on “safe” investments. In order to seek out a return, the majority of the trillions of dollars that have been created by the central banks has been ploughed into the stock market in order to chase returns. That is just another form of “inflation,” currency devaluation, monetary expansion. The Dow doesn’t sit at 25,000 because it’s worth it. It’s “valued” at ridiculous levels because it’s been the last refuge for those who need to make a return on their investments,… and for those who fear LOSING money on their deposits because of zero and even negative interest rates on deposits. This is not a normal, market environment. This is the consequence of distorting interventionism. The misallocation of those savings and investments, which would not be there otherwise, will become obvious once assessments correct down to accurate values. When that happens, those that sought return at the expense of safety, will experience significant losses.

The third of the articles I’ll share today was written by David Stockman, a former (and repentant) US Treasury official, who offers uncommon insights into decades of economic interventions and cycles. (Check out his excellent book which summarizes his experience in  and perspective on the US economy: The Great Deformation.) He considers our current situation The Greatest Bubble Ever and reinforces what has been described above. He points out that personal savings rates are at near historic lows, asset valuations at record highs, and there is no dry powder left in the Fed’s armory to deal with the next correction. This time will be a doozy.

and perspective on the US economy: The Great Deformation.) He considers our current situation The Greatest Bubble Ever and reinforces what has been described above. He points out that personal savings rates are at near historic lows, asset valuations at record highs, and there is no dry powder left in the Fed’s armory to deal with the next correction. This time will be a doozy.

“Valuation levels have never been higher relative to income and forward prospects. Central banks have never been on the precipice of a multi-trillion cash extraction and pivot to QT (qualitative tightening). And nine years of central bank fostered bubble inflation and fake recovery have never rendered the casino so complacent. In all, we’d say Wall Street is calling the sheep to the final slaughter.”

In summary, 2018 will bring significant challenges and change. But that’s good – although not painless. True valuations need to be found. Sustainable paths set upon. The unsustainable and the failing exposed and purged. Preparing appropriately and anticipating disruptions will make the transitions smoother, perhaps even profitable for the prepared. Alternatively, entrenching oneself in traditional asset classes, long-established systems, misguided nationalism, and poorly-founded economic beliefs may bring more discomfort than many are prepared to deal with. Stay nimble, challenge everything, live well beneath your means, and enjoy the innovations and change that the future holds.

And have a Happy New Year!