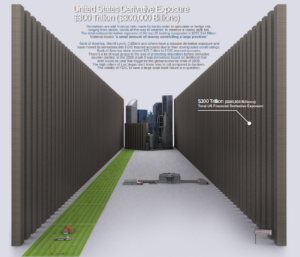

This graphic and title are lifted directly from demonocracy.info, which has great graphics to help visualize a very precarious financial system and monetary policy. With my interest spurred from the recent post on fractional reserve banking, I wanted to check on the current fund level for FDIC insurance (which looks to be $83B per page 94 of the 2016 GAO report – up from $25B a few years ago). Bank checking and savings deposits (M1 + part of M2, as I understand them) in the US appear to be about $13 Trillion. That would mean FDIC assets could cover 0.64% of total deposits. Of course, in the totality of the US financial system, which includes innumerable other forms of deposits, investments, instruments and debt, one might begin to get the sense that there is very little asset to cover astronomical liabilities. In comparison to the potentially $300T in derivatives, the FDICs cushion would cover 0.028% of losses. With that in consideration, one might do well to consider broad diversification into asset classes outside of numbers in a computer which hang tenuously upon a distorted and manipulated economy of wanton credit expansion, boom-bust cycles, artificially low interest rates, and ever-expanding debt. Some cautious skepticism wouldn’t seem entirely out of order.