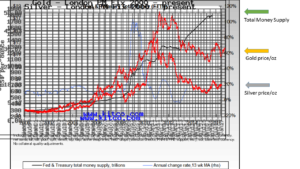

Overlaying three historical charts from the year 2000 to today: money supply in $Trillions, gold and silver in dollars/ounce. Metals dropped off of the growth curve in 2012, although the money supply has continued to grow (devaluing the dollar). One would expect metals prices to follow the inflationary trend upward, getting more expensive as the dollar value falls with increasing supply. The fact that they have not makes me think that they may be significantly undervalued. While I do not use metals as an investment, per se, I find them very useful as stores of value – much moreso than the fiat currency of a government-controlled, ever-expanding money supply which can only continue on its current growth curve as printed/credit-expanded money is used to cover unfunded and untenable liabilities owed to the public. My take away: more metals.

I pulled these charts from www.kitco.com and from www.nowandfutures.com

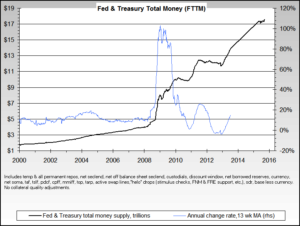

Edit on May 6, 2017: After I posted this, I was thinking about one of the points that David Stockman (and others) have made regarding the correlation in money expansion and rising stock prices. Particularly, I think I first saw this vividly in Stockman’s book The Great Deformation: The Corruption of Capitalism in America, wherein he describes the basically 1:1 correlation between Fed money expansion and corporations making use of that easy money and credit to indebt themselves in order to buy back their stocks. This decreases the number of outstanding stocks, increasing the earnings-per-share number, making the stock look more valuable than it really is. Additionally, for individuals, easy credit allows them to keep high debt levels while pouring money into an increasingly distorted market. A third factor is that as the Fed keeps interest rates extremely low, there is nowhere to “invest” that is safe and simultaneously offers a decent rate of return. Historically, one could park one’s savings in a CD and safely make 5%. Now, with artificially low interest rates near 0%, and in some countries rates are negative, people “chase returns” in the only place that they hope to keep a positive return on investment: that increasingly distorted stock market which is inflating/devaluing values in step with the flood of dollars. (Peter Schiff has significantly commented on all of this, as well.)

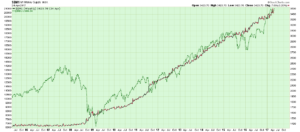

See the below chart to follow what looks to be only M1 (which is only cash and demand checking deposits which can be quickly liquidated, and does not include all of the expanded monetary credit lines of M2 and M3 – see Investopedia on the topic) in correlation with the Dow Jones Index. All of that money seems to be dumped right into the stock market. There has been no real growth. The Dow is just an indirect indicator of money supply expansion. (At another time, we might discuss M1. As it includes savings and checking accounts, we might dig into how much of that money even exists in a fractional reserve banking system wherein the financial institutions hold 90%+ of those dollars only as numbers in a computer. There is no paper cash or real asset to back those liabilities to account holders.)

chart source: Stockcharts, which was linked from a Gold Eagle article.