I know, I know. EVERYBODY has to write about BTC these days. But, I get to offer my two cents on my own webpage,… so suck it. As of current writing, BTC to USD exchange is roughly $55,000. So, my two cents is only worth 0.0000003531 BTC.

I bought a depressingly small amount of BTC a few years back. Had I been more enlightened, I’d be retired with my gains. Ultimately, the message that I want to convey is that I am a BTC supporter by way of philosophy and free market economics, as opposed to investment, per se. I am not chasing a gain. I am looking for a life raft.

Like precious metals, BTC is a diversification strategy and an insurance policy. Of course, it could go to zero and fail. That’s fine. Compared with the trajectory of the US dollar, I’ll take those risks. In reality, my diversification across contrarian asset classes is merely a risk mitigation strategy.

BTC is admittedly a fiat currency – it is not tied to, based upon or backed by any asset. I’m okay with that. In that regard, it is no different from any world currency. The difference, which is its brilliance, is that it cannot be expanded ad infinitum, without limit, digitally diluted and devalued, printed up by a central bank or government to be used to pay its bills and unfunded obligations while destroying the savings and purchasing power of the currency. It is DECENTRALIZED. BTC has a finite and decreasing ability to expand. It has boundaries, rules, limits. The dollar does not. No world currency does. Maybe something better than BTC will come along. Wonderful. For now, it is useful to me for its potential.

Yes, BTC is very volatile, with extreme gains (and some losses) in recent months and years. It can bounce in exchange value by 10-20% in a very short amount of time. Again, I’m okay with that. I’m holding the digital asset for a longer term (as well as buying small amounts biweekly even at high valuations now) and taking a risk that it will retain some value in the future. I am taking a risk that BTC will be an exchangeable currency for the purchase of goods and services, as well as potentially a store of some value. As a caveat, I would never “invest” an amount of my earnings (and my family’s finances) into BTC or other risky asset that, were I to lose all of it, would result in financial hardship.

However, it is just that risk of the financial hardship brought about by dollar dependency that drives my interest in BTC. Given the fiat nature of national currencies, the extreme monetary expansion, the “money printing” (although now digital), the unfathomable national debt and stimulus and bailouts, the likelihood of negative interest rates for bank savings and checking accounts in the US (as is already the case elsewhere), the nosebleed over-valuations of stock market bubbles based on stagnant real valuations as corporations and individuals dump money there trying to chase a gain that can no longer be acquired by saving, the risk of inflation (dollar devaluation and declining purchasing power), the probability of government “digital currencies” which will only be “fiat on steroids” with the removal of ANY limiting factors for expansion mixed with the potential for some extreme controls on how/where that “money” might be tracked and spent,… I’m looking to de-dollarize where able. Most of this diversification is into precious metals which can be done with private storage in national and international depositories, rolling retirement funds into precious metals IRAs, cautiously investing in stock market funds which hold actual metals (do your due diligence to avoid “paper metals”), holding some metals in a safe deposit box.

I came across an insightful article that summarized my approach to BTC this week: Mark E. Jeftovic’s “We’re In A Bubble That’s Too Big To Fail.” One of the specific quotes Mr. Jeftovic lists from a prior article commentarian (unattributed to the anonymous but apparently brilliant author, unfortunately) was spot on for my view! [Unattributed Author, can we be friends? I like you very much.]

“I had the thought that Bitcoin is like a hole in the wall of a burning building. The burning building is the petrodollar. The Bitcoin hole in the wall doesn’t meet any standard definition of a door. It wouldn’t pass a building inspection and it may not last long. It will most certainly be replaced by something else in the long run. But in the short term, no one inside that burning building really cares about any of that and the ones that first smelled smoke are already pouring through it. Many more will follow and some, sadly, will die in the fire. There are other exits from the building too, some may be safer than others, but the most important thing is getting out of the burning building as quickly as possible.”

As time permits this morning, I’ll add a few extra thoughts and graphs on the financial trajectory of the dollar, but the above is enough to illustrate the point.

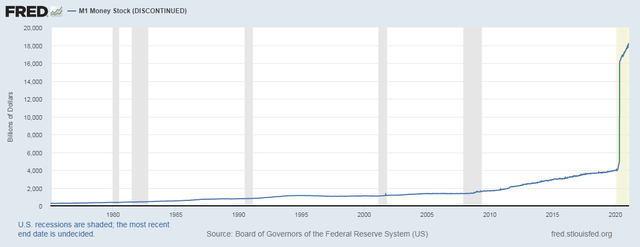

Here’s a graph from the Federal Reserve’s Economic Data (FRED), as shared by a seekingalpha article discussing inflation risks. M1 is the amount of readily spendable currency (cash and checking account balances, essentially. M2 would include M1+ other funding that can be quickly made liquid, like savings accounts and money markets… now, we’re not even going to get into Fractional Reserve Banking wherein banks only have about 3% of the funds that are claimed as balances… so don’t you all run out to get your non-existent money!… which, BTW, ZH quote: “The FDIC only has $109 billion to insure the entire $13 trillion US banking system. That’s less than 1%!” But, I digress.)

Note the massive increase in M1 recently. The ongoing argument is about why inflation (significant price increases, falls in purchasing power, devaluation) has not been a problem. Most answers seem to revolve around a declining “velocity” of money – in essence, people and corporations are parking, or sitting on, their cash. The money isn’t being used in the market, exchanging hands. Another time, we’ll have to analyze why it takes so much money printing to actually fend off “deflation.” If/when that parked money starts to be mobilized with velocity, and floods the market with trillions of dollars,….

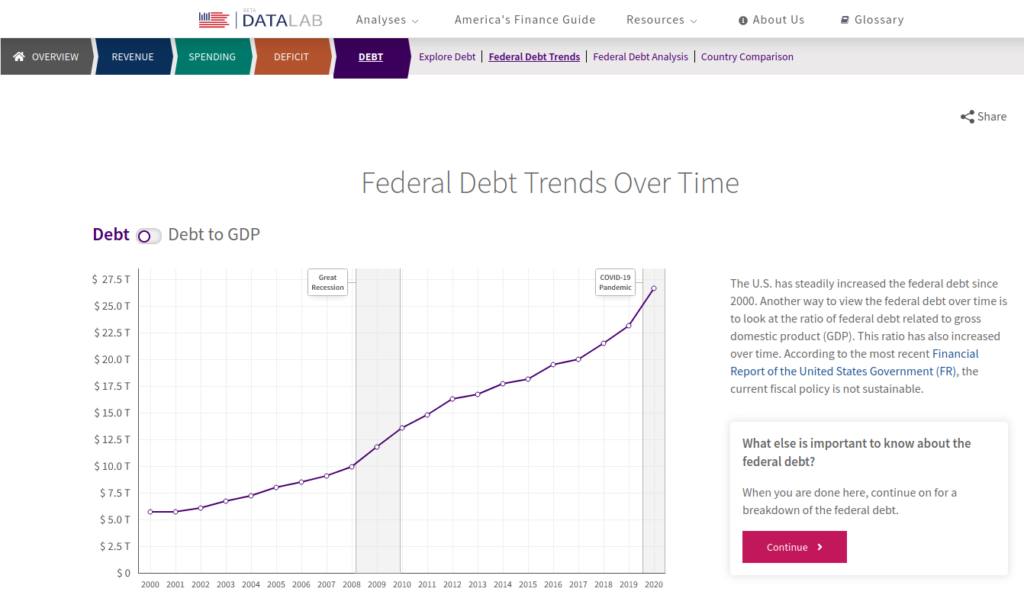

Here’s a graph of the perpetually rising national debt of the US. That debt is now well above 100% of GNP (see that ratio trend here). Obviously, the debt cannot be repaid. That does not appear to be a goal, in the slightest, regardless of administration.

Can debt be “managed” forever?

At what point do interest payment obligations eat into the available funds?

What rate of money expansion is too much?

When do other countries decide that buying American bonds (Treasuries) will pay them less in stability and interest than the declining value of those bonds held over time (inflation adjusted return)?

What happens if/when enough Treasuries cannot be sold to keep supplying the rising debt requirements?

By continuing to digitally expand the dollar into an ever-increasing pool of M1, what are the devaluation/inflation risks when “velocity” changes?

If the government can increase M1 by trillions in a given year, as well as take on perpetual national debt, (exceeding total tax revenues from the public – estimated at $3.86T for 2021), then why not just eliminate taxation altogether and fund all of the government’s programs and expenditures through money expansion – which is argued by mainstream economists to have no negative economic effect?

When other countries tire of having to do business in dollars for oil (petrodollars) and for most other international trade, and tire of being held hostage or embargoed by coercive and extortionist international policy and threat, then create their own systems outside of the post-WWII Bretton Woods monetary system imposed upon the entire globe, what will happen to the demand for dollars?

What happens when the dollar is no longer the World Reserve Currency? (Russia, China and other countries have been developing financial escape systems for some time.) The dollar has only been the dominant currency since the late 1940s.

What happens when the US Empire joins the history books with every other previous empire throughout the millenia of world history? Will that shift happen within our lifetimes? Within coming years? Some might argue that the peak has already taken place, the trajectory is now retraction, and the bubble burst is upon us. The Soviets didn’t foresee the demise of their Empire in the late 1980s, but theirs fell apart very quickly – almost overnight.

With such a massive level of debt, global military occupation and policing effort, and untenable domestic and international liabilities, how quickly might the American Bubble burst, forcing us all into uncomfortable adjustments?

Prepare well, friends.