“Once Latin America’s richest country, Venezuela can no longer feed its people, hobbled by the nationalization of farms as well as price and currency controls.”

I posted elsewhere some thoughts on the economic, political and humanitarian disaster of Venezuela, and wanted to preserve some of that here. I lived in Venezuela for a few years in the 1990s and left about the time that Hugo Chavez was coming to power. Given my connection to that country, I have followed its decline with saddened interest. Now, post-Chavez, Maduro has accelerated the dysfunction and demise of seemingly every societal system.

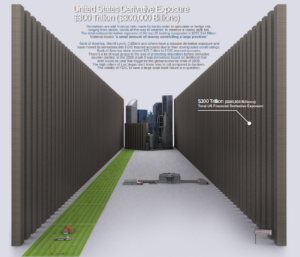

When I left Venezuela in 1992, about 16 Bolivares bought a dollar, if I remember correctly. Now, it takes 5,000. (Of course, I think their central bank was recently about to lop off a few zeroes to make things look better.) In an attempt to control everything and everyone, their Gov has nationalized (and destroyed) almost all commerce, and hyper-inflated their currency to the point of near uselessness. They’ve driven businesses out of business, and international investment entirely out of the country. This is Gov doing everything it wanted to do without public restraint. Gov writ large. In its near fullness. Statism unveiled. Perhaps the only things we don’t currently witness that would fulfill the completeness of the state are wars of Empire (which they can’t afford) and political prisons/work camps (of which there are multiple stories of political enemies being removed and imprisoned, just not on large scales. Perhaps that is unnecessary, as their silence is culturally imposed or they’ve already fled.)

I was in Venezuela for almost two years in the 90s. Beautiful, fertile, temperate climate, diverse terrain, hundreds of miles of Caribbean coast, tourism-ideal land…. but for Gov. One of my vivid memories is of all of the fruit that would rot on the ground in the smaller towns. Massive mango trees were common, and often, there would be scores of rotting fruit on the ground from overabundance. Similarly, all manner of other fruits were plentiful – some of which I had never before tasted: varieties of banana and plantain, star fruit, guayaba, guava, papaya, others I can’t remember the name of. There is no reason that country should not be an agricultural powerhouse to the world, much less be able to feed its people… other than the reason that we’ve mentioned.

One thing that I disdained about their culture, however, is likely a direct contribution to their situation. In essentially every instance, the common colloquialism was, “si Dios quiere.” Essentially, “God willing.” Any future plan, appointment, project or even luncheon for the next day was qualified with that thoughtless suffix. It was if they had culturally and religiously abandoned their own responsibility, will, forethought, commitment, etc. in exchange for whatever might occur… because certainly that would be God’s will. They always had a Divine out, a Holy Excuse, for their failings and apathy. Myself, even as a Christian at the time, I found this horribly annoying, lazy and unproductive. I think that this mindset especially put that people at risk for Gov stepping in to impose all manner of controls. The people had abandoned self-responsibility, awareness, intellectual curiosity and even self-preservation to a faulty security that God would just take of every little aspect of their lives without any work or attention on their own part. Government and its actors had the cover and distraction they needed to do whatever they wanted to control, regulate, inflate, devalue, nationalize, self-promote, nepotize, conspire. History is replete with Gov’s use of religion to subdue and control the masses. Unfortunately, the Venezuelans will have their own chapter in that book.

maps from geology.com